We recommend selling the following OTM Put Option of AMZN, with a profit target of 25% and stop loss of 50%:

Sell AMZN Feb 7 240 PE

Our analysis behind this recommendation is as follows:

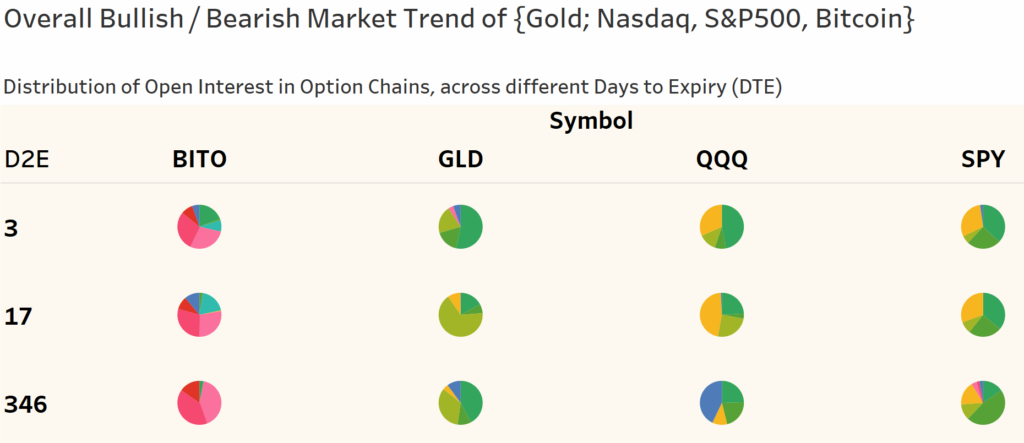

A) Analysis of Stock Market Indices

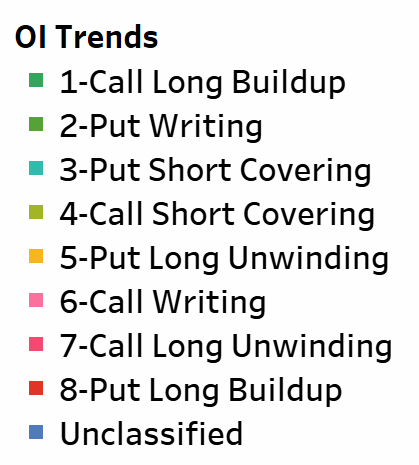

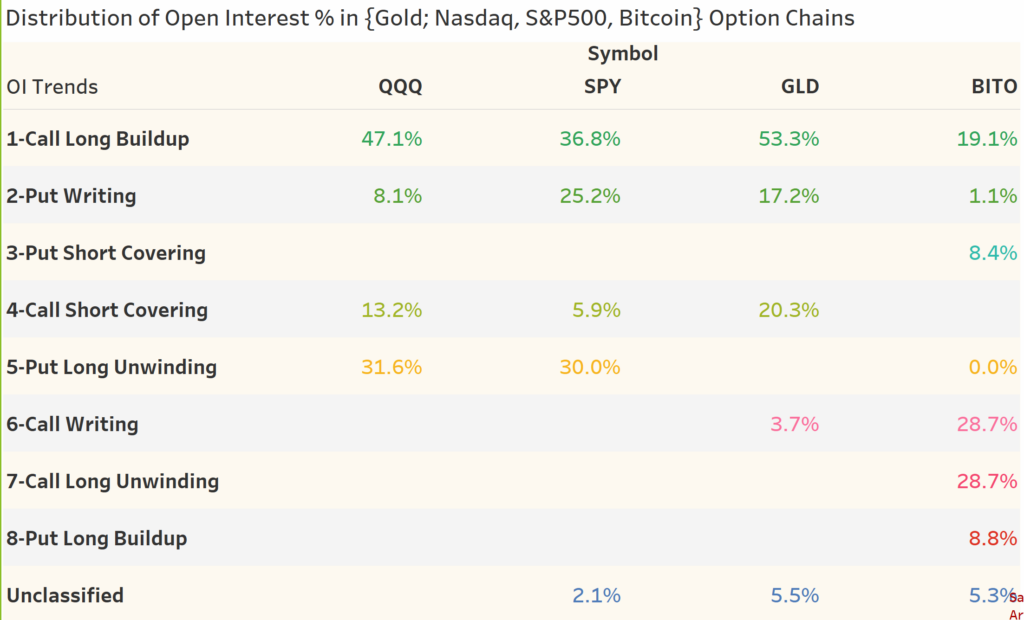

1) The Market Indices are overall moderately Bullish today! See the distribution of Open Interest for SPY and QQQ below. GLD is also quite Bullish today, although BITO is bearish.

2) For SPY, QQQ options expiring in 3 days (weekly), 74.0% of the total open interest reflects “Cal Long Buildup” and “Put Writing” indicating a moderate BULLISH sentiment.

B) Analysis of Mag-7 Stocks

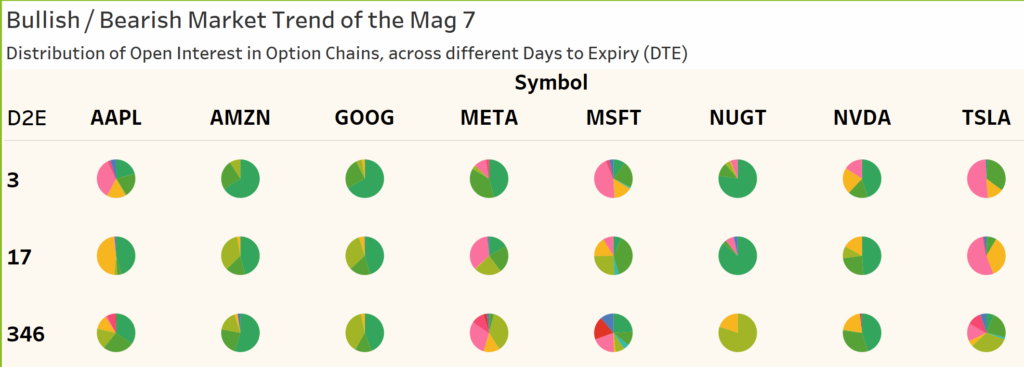

3) AMZN and GOOG show the strongest BULLISH sentiment among the Mag 7 stocks, based on the aggregated open interest distribution across weekly (3 DTE), monthly (17 DTE), and LEAPS (346 DTE) option chains.

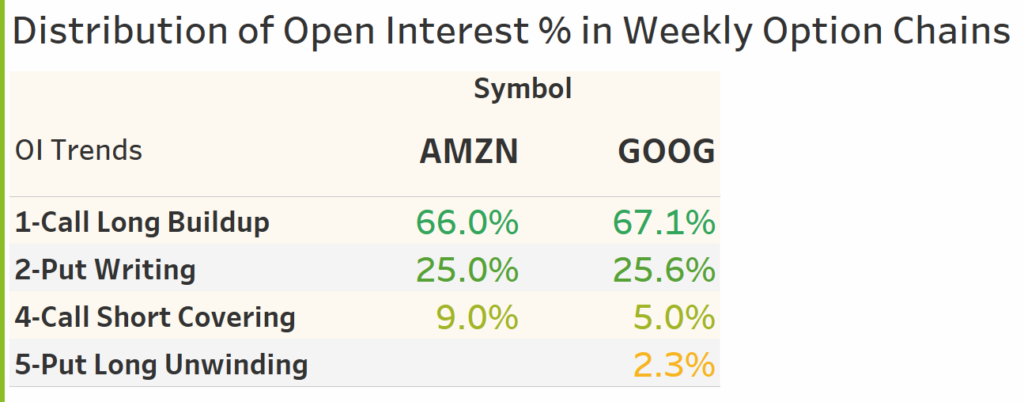

4) AMZN is the most BULLISH, based on the weekly (3 DTE) option chains, with 66.0% of its total open interest reflecting “Call Long Buildup”, 25% reflecting “Put Writing” and a further 9% reflecting “Call Short Covering”, signaling strong BULLISH sentiment.

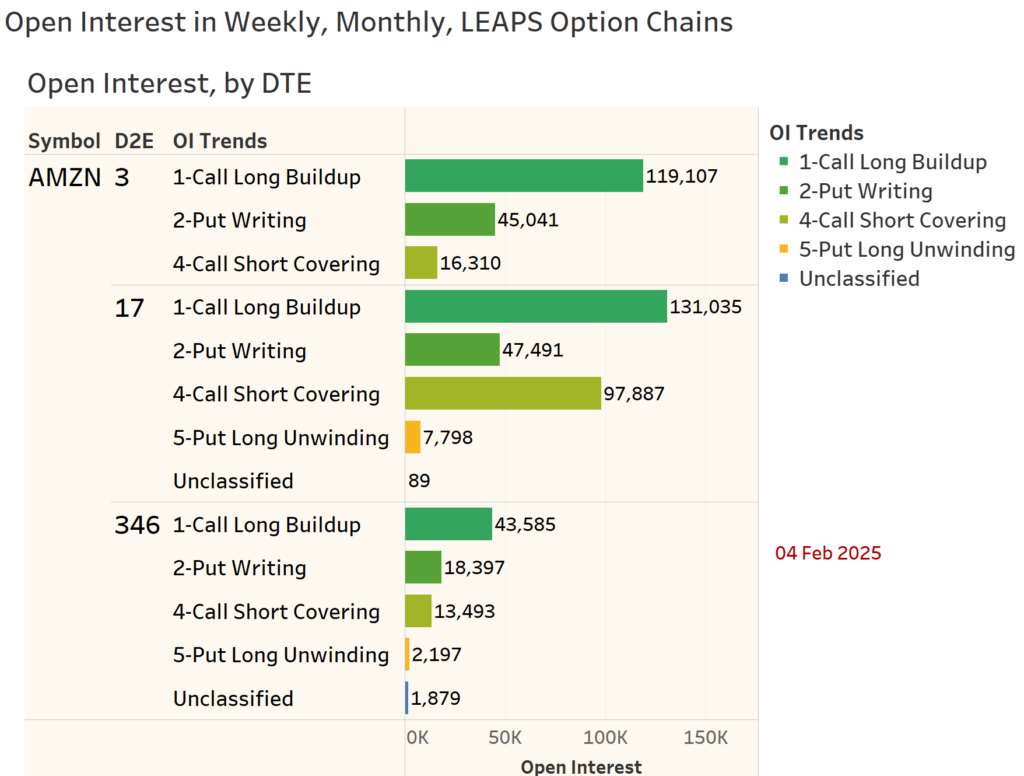

5) Moreover, AMZN exhibits strong BULLISH sentiment, as reflected in the absolute Open Interest distribution across its weekly, monthly, and LEAPS option chains.

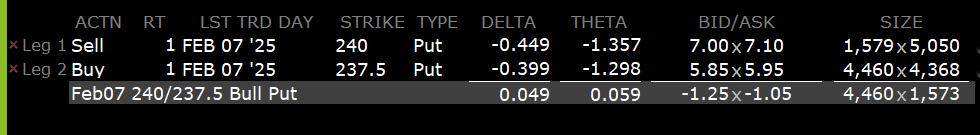

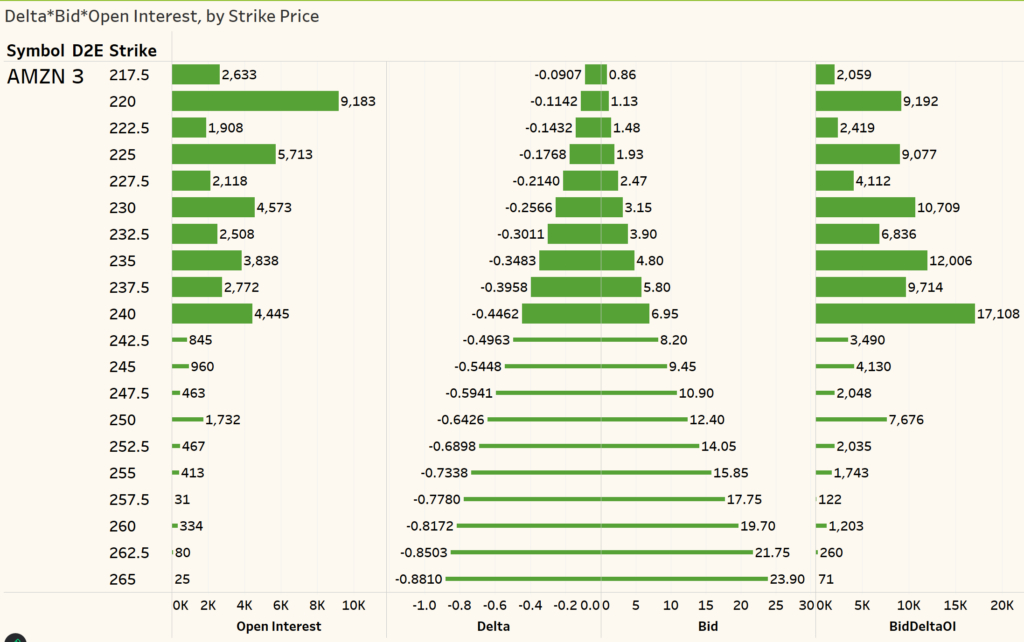

6) In order to determine the best Strike Price to trade, we review the Open Interest at different Strike Prices of Put Options of AMZN in the weekly (3 DTE) option chain.

We notice that 240 PE has 4445 Open Interest, 44.62% Delta and 6.95 premium.

Conclusion

We recommend selling the following OTM Put Option of AMZN, with a profit target and stop loss:

Sell AMZN Feb 7 240 PE

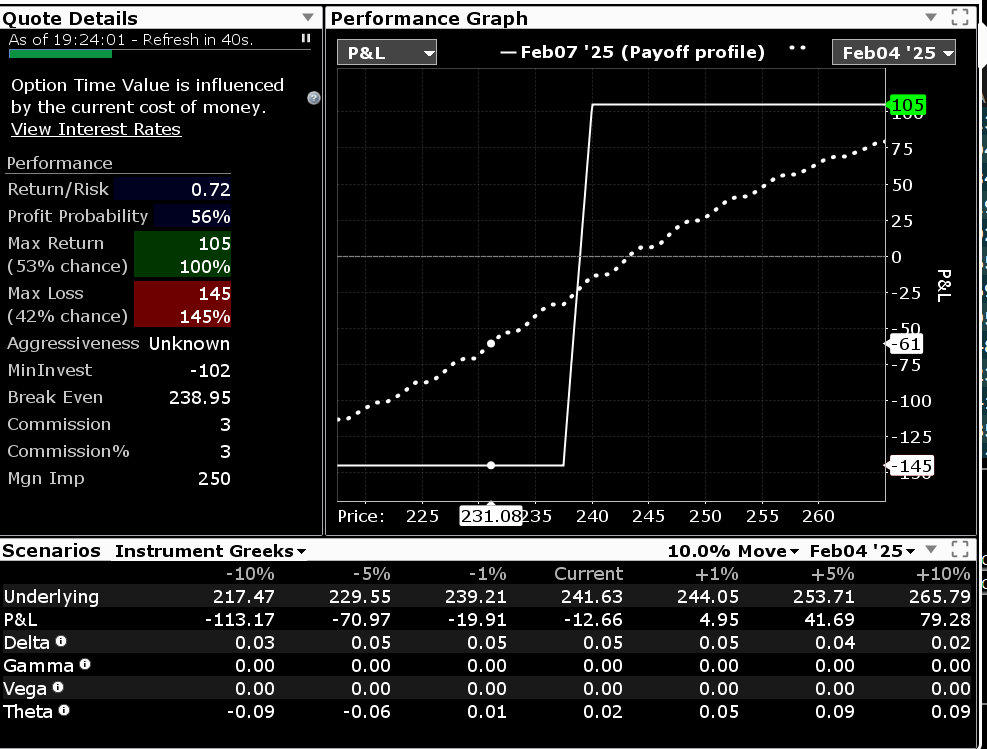

Appendix — Sample Trade — Bull Put Spread on AMZN