Bullish on First Solar (FSLR) — Sell FSLR MAR31 150PE

Analysis of Solar Stocks – ENPH, FSLR, NEE

We review three “Solar” stocks. Enphase Energy (ENPH), First Solar (FSLR), and NextEra Energy (NEE) operate within the broader renewable energy sector but cater to distinct niches. ENPH focuses on solar technology, specializing in microinverters and energy storage solutions that enhance residential solar efficiency. FSLR operates in solar panel manufacturing, leading in thin-film photovoltaic panels for utility-scale projects, known for their durability and performance in diverse climates. NEE bridges renewable energy and utilities, combining traditional utility services with one of the largest renewable energy portfolios globally, including solar, wind, and battery storage. Collectively, these companies play vital roles in advancing clean energy adoption across residential, commercial, and utility-scale markets.

Solar Stocks Overview

| Company | Industry | Business Focus | Strengths | Challenges |

| ENPH | Solar Technology | Specializes in solar microinverter systems, energy management, and storage solutions. | Market leader in microinverter technology, strong North American presence, and integrated energy storage solutions. | Declining residential solar demand and pricing pressures affecting earnings. |

| FSLR | Solar Panel Manufacturing | Leading manufacturer of thin-film photovoltaic solar panels, focused on utility-scale projects. | Cost-effective, durable panels with strong project backlog and government incentives. | Competition from low-cost Chinese manufacturers and supply chain risks. |

| NEE | Renewable Energy & Utilities | One of the largest electric utility companies with a strong renewable energy portfolio. | Diversified energy portfolio, stable utility revenue, and aggressive renewable energy expansion. | Regulatory risks, rising interest rates, and exposure to weather-related disruptions. |

Solar Stocks – Fundamentals

| Company | Market Capitalization | Revenue (TTM) | Net Income (TTM) |

| ENPH | $17.65 billion | $1.83 billion | $275.97 million |

| FSLR | $31.20 billion | $3.56 billion | $1.02 billion |

| NEE | $151.19 billion | $23.99 billion | $7.49 billion |

| Company | P/E Ratio | Profit Margin | Debt-to-Equity Ratio | Return on Equity (ROE) |

| ENPH | 69.70 | 7.7% | 1.0 | 15.5% |

| FSLR | 31.53 | 32.4% | 0.2 | 10.8% |

| NEE | 19.69 | 31.2% | 1.3 | 11.2% |

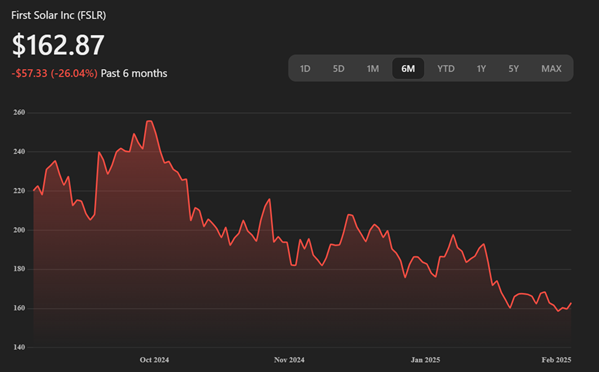

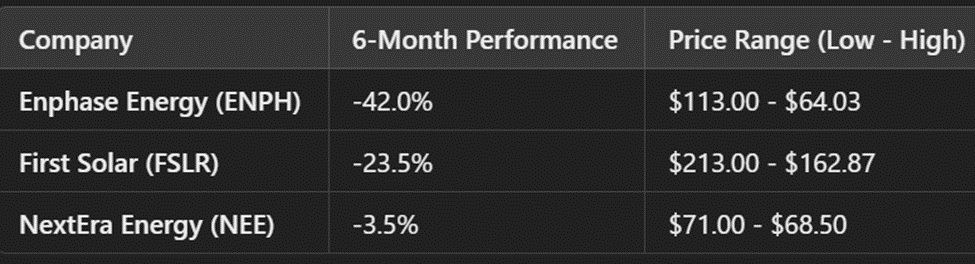

6-Month Price Chart and Performance of Solar Stocks

INSIGHTS FROM OPTION CHAIN ANALYSIS – FOCUS ON FSLR

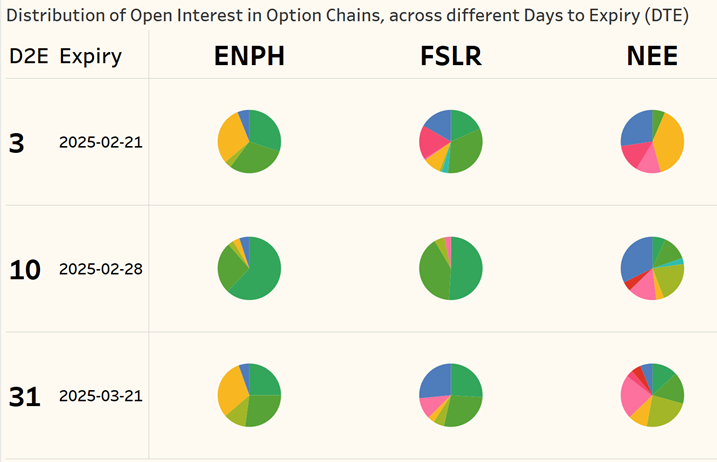

Insight 1: ENPH, FSLR, NEE are moderately bullish in the short term

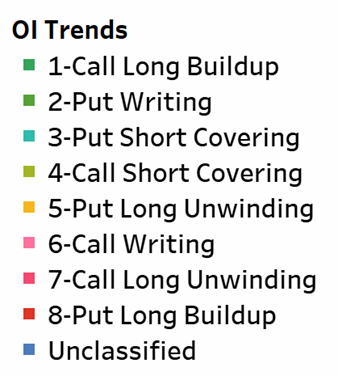

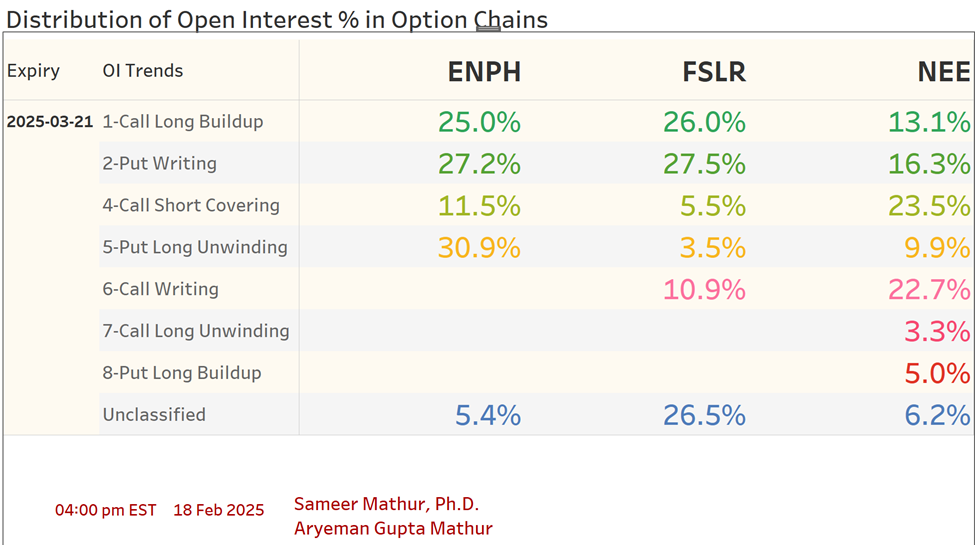

The pie charts illustrate the bullish or bearish sentiment by showing the distribution of Open Interest, color-coded as follows:

Insight 2: FSLR, is moderately bullish

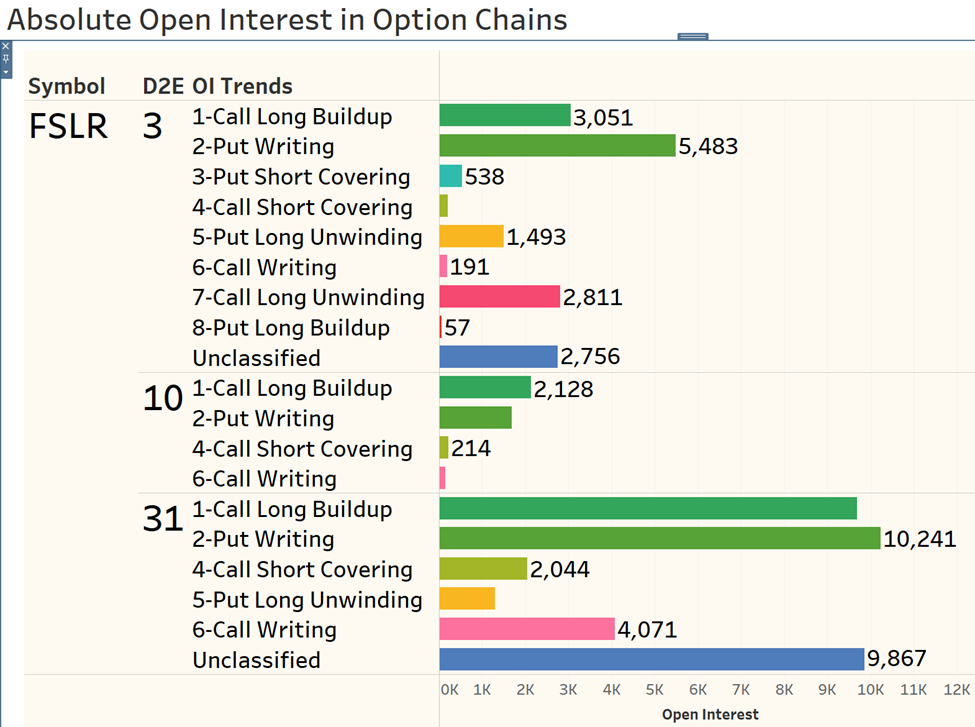

For FSLR, analyzing Option Chains with 3 DTE, 10 DTE, 31 DTE, we notice consistent bullish Call Long Buildup.

Insight 2: FSLR, is moderately bullish

For FSLR, analyzing the Option Chain expiring on March 21 (33 days to expiration), there is a 26% buildup in long call positions and 27.5% in put writing.

Insight 3: Sell FSLR MAR31 150PE

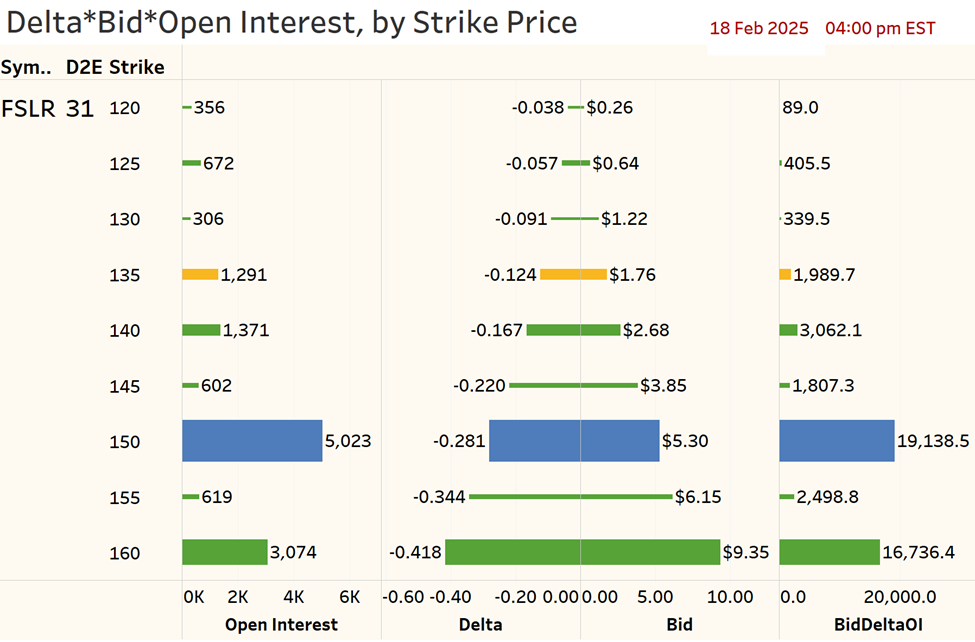

Consider the FSLR Option Chain expiring on March 21 (33 days to expiration).

Focus on the OTM Put Options.

Notice that the Open Interest is highest at the 150-strike price and the Bid price is $5.30.

Selling Cash-Secured Put Options could be profitable here!

Sell FSLR MAR31 150PE at 5.30

- Trade: Sell FSLR MAR31 150PE at $5.30

- Premium Collected: $530 (per contract)

- Capital Secured: $15,000 (for 100 shares at $150)

Possible Outcomes:

- FSLR stays above $150:

- The put expires worthless.

- We keep the $530 premium (3.53% return in ~1 month).

- FSLR drops below $150:

- We’re assigned 100 shares at $150.

- After premium, our effective cost is $144.70.

- We can hold the shares or sell covered calls.

Why Consider This Trade?

- High premium due to volatility (~3.5% return).

- We’re paid to wait and possibly own FSLR at a discount.

- Works if we’re bullish or neutral on FSLR.

Risks:

- Significant drops in FSLR price lead to losses.

- If FSLR soars, we only keep the premium.

Bottom Line:

We earn $530 if FSLR stays above $150 or get assigned shares at $144.70—a discounted entry with potential for further income via covered calls.