Trade Recommendation:

We recommend selling the following OTM Call Option of SPY

Sell SPY Feb 14 605 CE

Our bearish stance on SPY is based on market indices, options flow, and open interest trends.

A) Market Indices Analysis

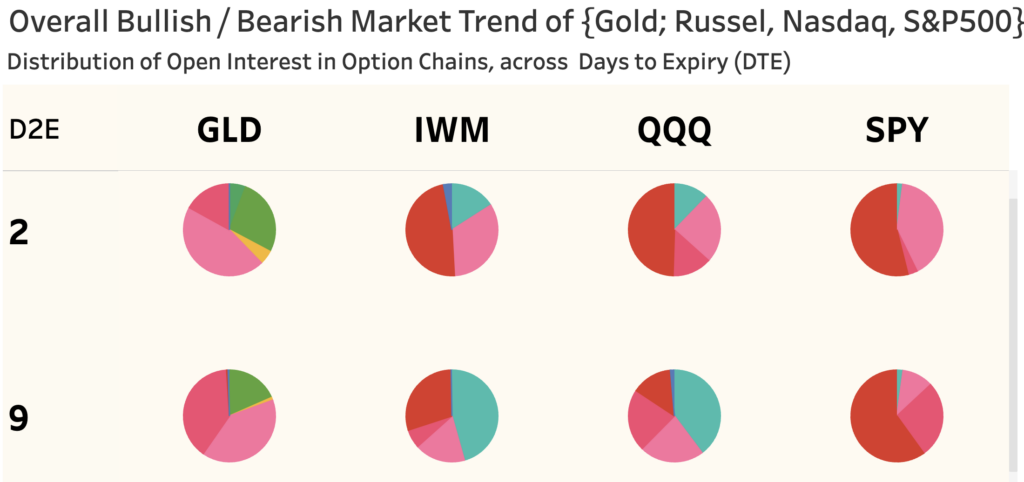

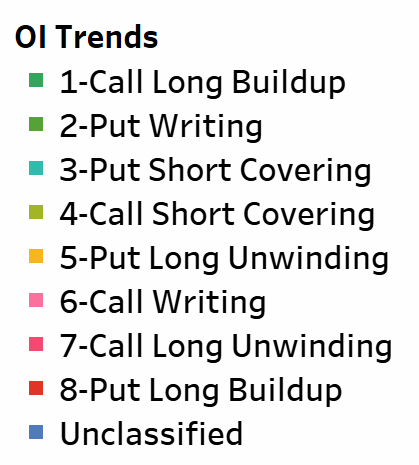

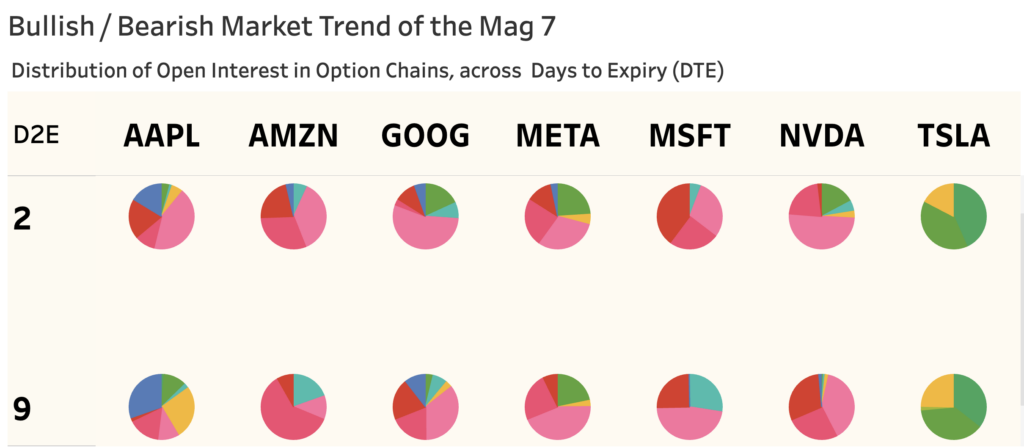

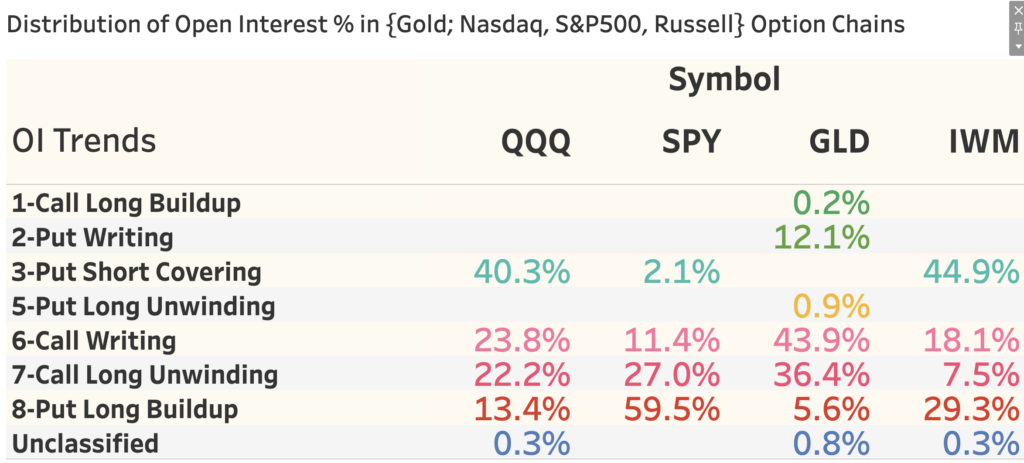

1) Overall Market Sentiment: The broader market shows a moderately bearish trend, with SPY and QQQ options favoring bearish positions.

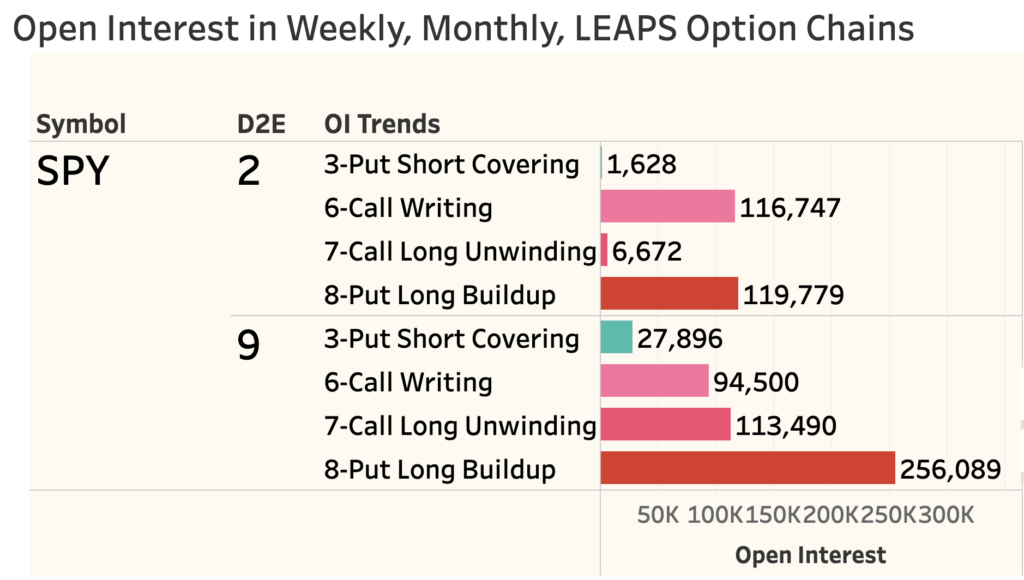

2) SPY-Specific Sentiment: Weekly SPY options (2 DTE) indicate 59.5% bearish open interest, driven by:

- Put Long Buildup (creating new long positions)

- Call Long Unwinding (reduction in bullish bets)

These suggest institutional positioning for a downturn.

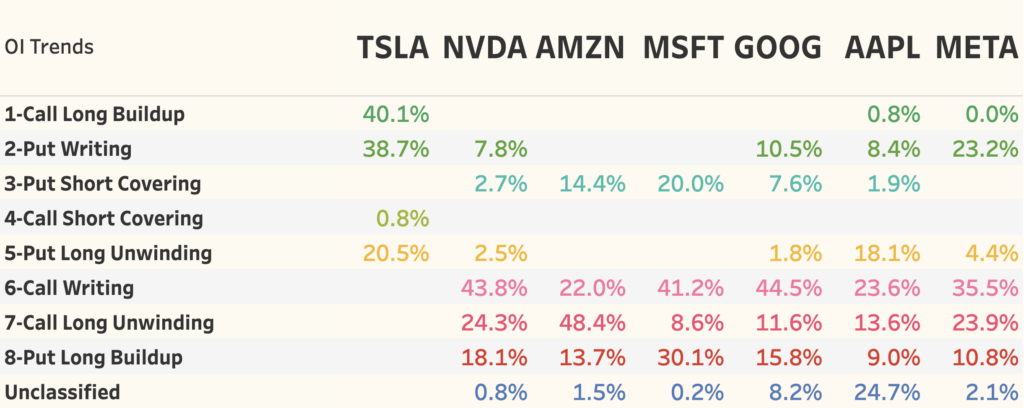

B) Analysis of Mag-7 Stocks

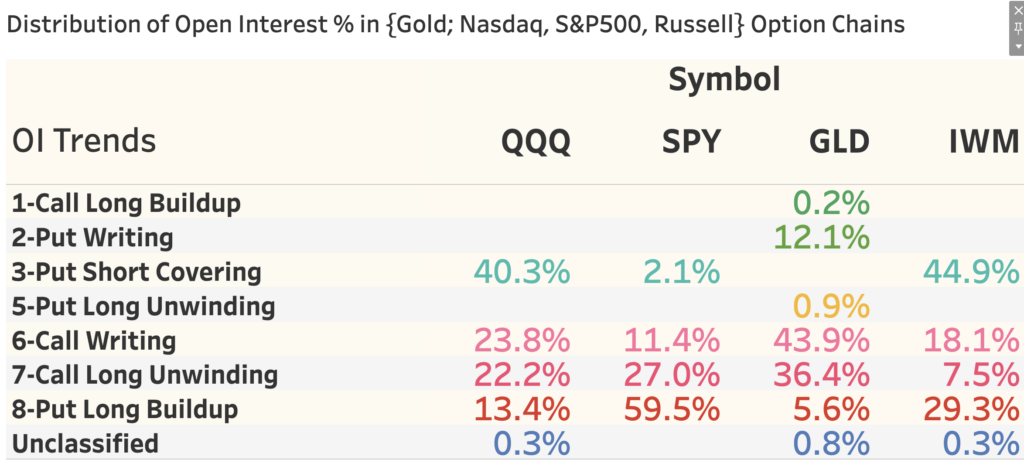

3) MSFT as a Bearish Indicator: Among the Mag 7, MSFT has the strongest bearish sentiment across weekly (2 DTE) and monthly (9 DTE) chains.

4) SPY More Bearish Than MSFT: SPY shows a stronger bearish signal, with the highest Put Long Buildup and Call Long Unwinding.

5) Absolute Open Interest Trend: SPY’s OI across weekly and monthly chains indicates downside risk.

Thus, we are highly BEARISH on SPY

C) Selection of the Optimal Strike Price

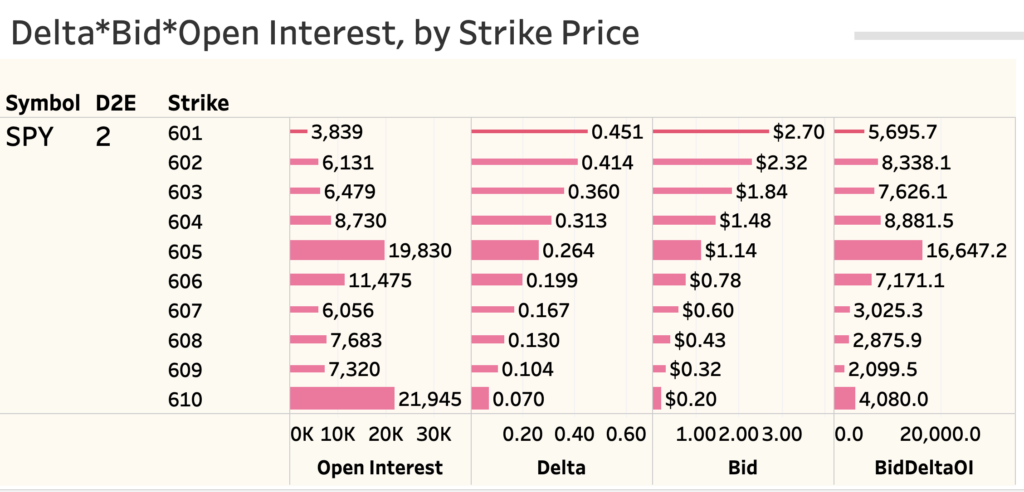

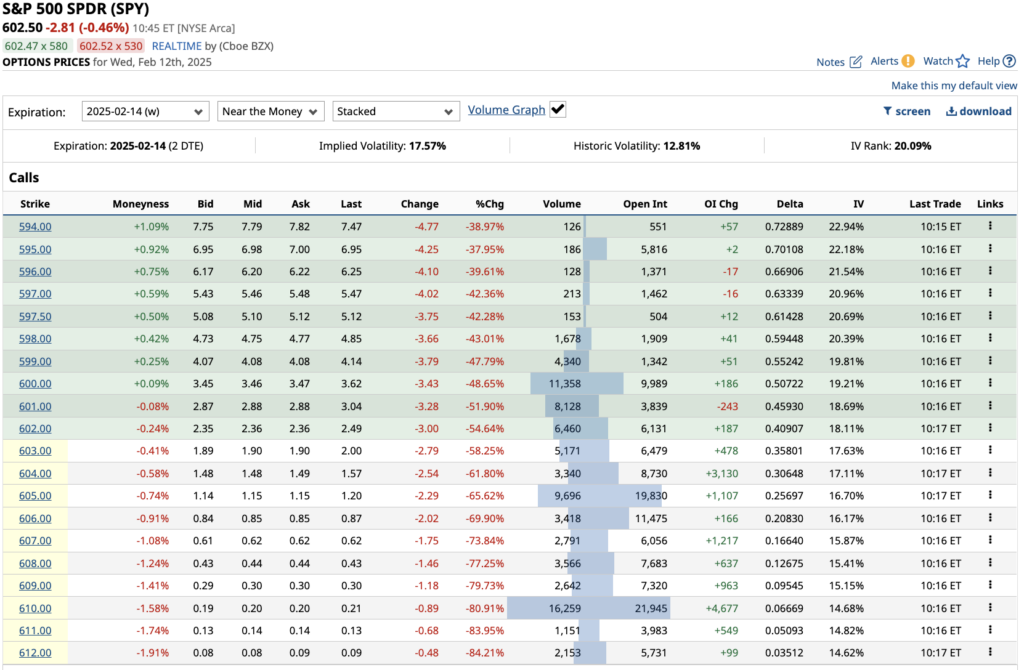

6) Targeted Strike: Reviewing SPY’s weekly (2 DTE) option chain, 605 CE stands out with:

- The 605 Call Option (605 CE) stands out with:

- 19,830, Open Interest contracts

- 26.4% Delta, implying a low chance of expiring ITM

- $1.14 premium, offering a favorable risk-reward ratio

We notice that 605 CE has 19,830 Open Interest, 26.4% Delta and 1.14 premium.

Conclusion: Our Trade Recommendation

Based on the above analysis, we suggest recommending the following options trade:

Trade Setup:

This trade aligns with prevailing bearish sentiment, leveraging institutional positioning.

Sell SPY Feb 14 605 CE

Appendix

A1: SPY Option Chain for 2 DTE (Expiring Feb 14, 2025)

A2: Price Chart for SPY 605 CE (As of 10:25 AM EST, the bid price was $1.54)

By strategically selling the 605 CE, we leverage the bearish sentiment and maximize the probability of capturing premium decay. As always, risk management remains a priority, with dynamic adjustments based on market movement.